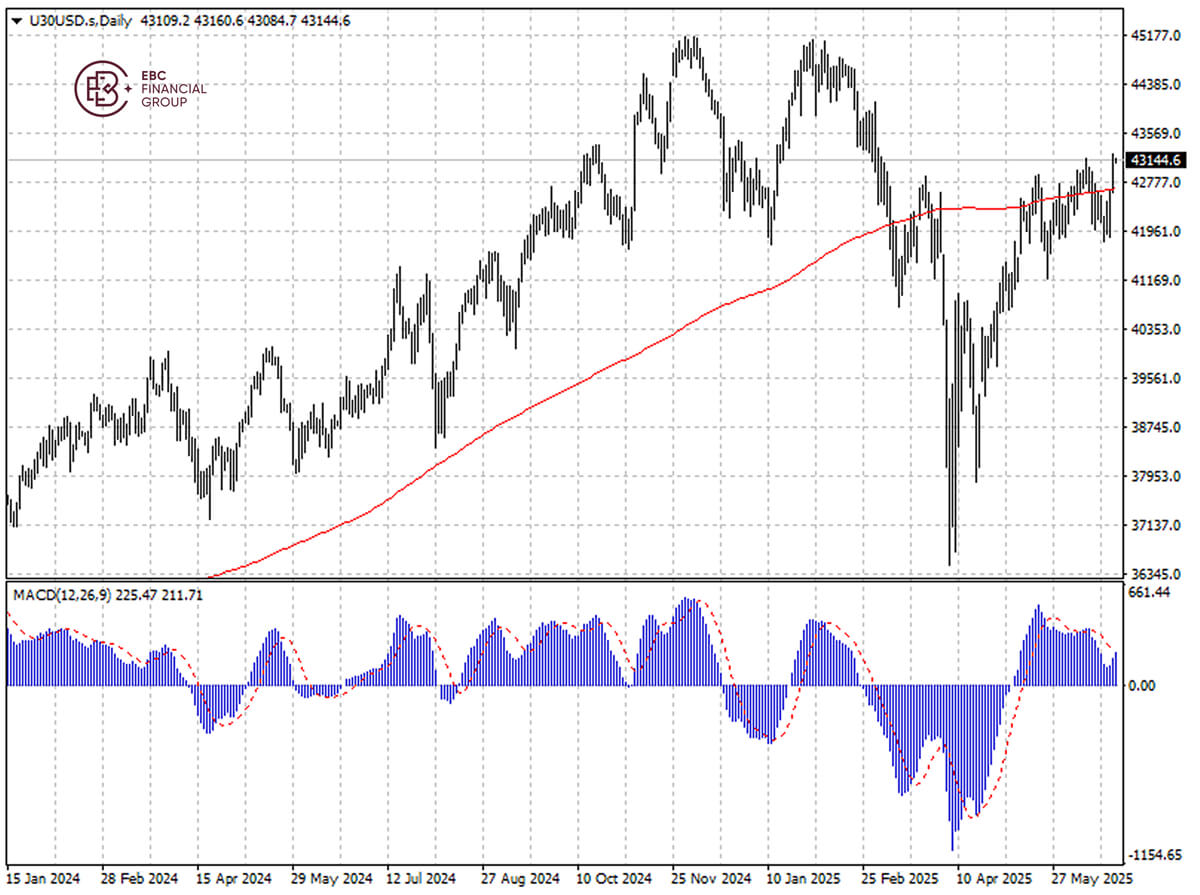

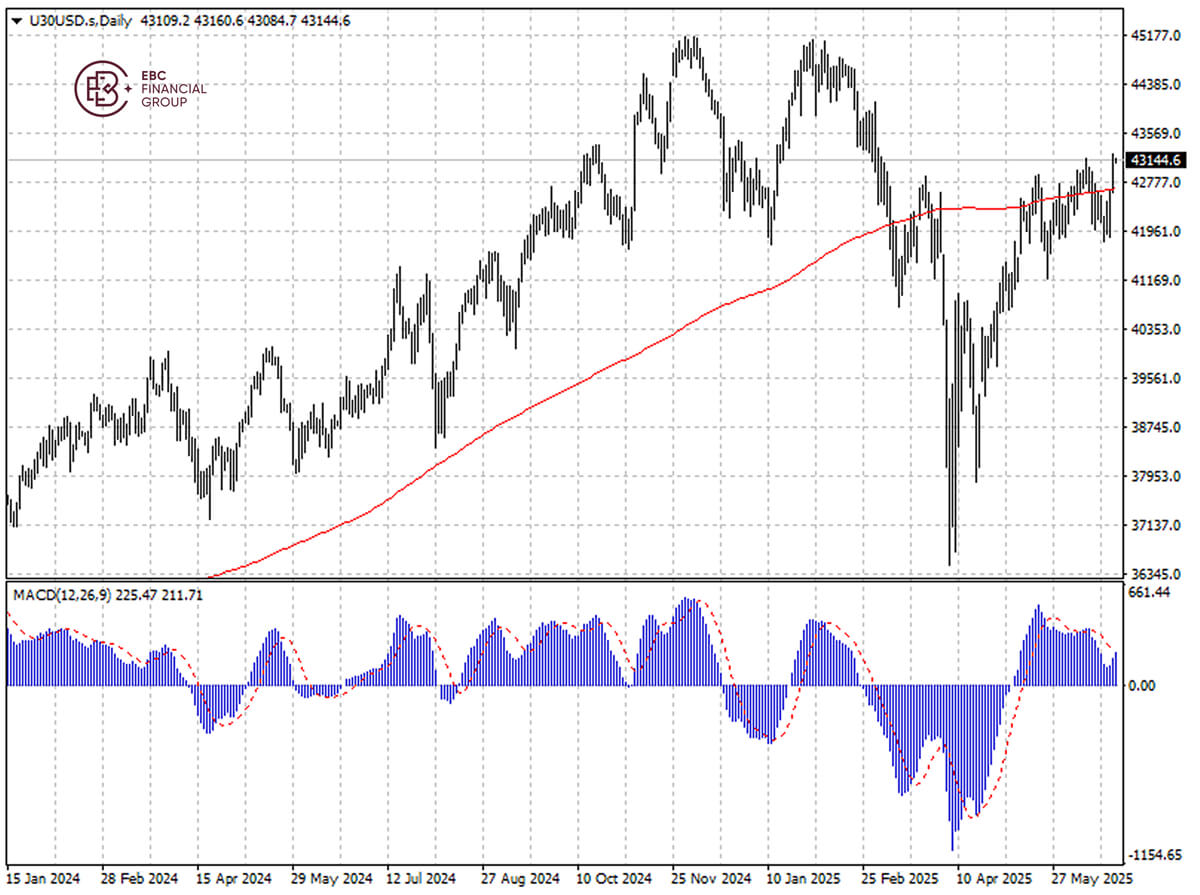

The Dow has pushed above 200 SMA, but bearish MACD divergence may undercut the rally. If the double top pattern materialises, the index will likely retest the low around 42,300.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The Dow has pushed above 200 SMA, but bearish MACD divergence may undercut the rally. If the double top pattern materialises, the index will likely retest the low around 42,300.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.EBC Markets Briefing | Wall St cheers a fragile truce

The Dow has pushed above 200 SMA, but bearish MACD divergence may undercut the rally. If the double top pattern materialises, the index will likely retest the low around 42,300.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The Dow has pushed above 200 SMA, but bearish MACD divergence may undercut the rally. If the double top pattern materialises, the index will likely retest the low around 42,300.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.Contact:

mkt@ebc.comDisclaimer:

Investment involves risk. The content of this report is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Publication date:

2025-06-25 08:25:04 (GMT)