Daily Market Outlook, April 23, 2024

On Tuesday, most Asian stock markets are experiencing gains, influenced by the positive performance of global markets and a reduction in concerns about a larger conflict in the Middle East following measured counterattacks by Iran and Israel. Traders are also taking advantage of buying opportunities as they await the release of various important U.S. economic reports on personal income and spending. However, concerns are mounting in the markets regarding the possibility of the US Federal Reserve refraining from cutting interest rates throughout this year. Speculation is arising that the next move in US rates might lean towards an increase. In the UK, March government borrowing surpassed expectations, leading to a £7 billion overshoot in the full-year deficit for 2023/24 compared to the Office for Budget Responsibility’s forecast.

Today's focus lies on purchasing managers’ indices. The UK PMI manufacturing headline index unexpectedly climbed back above the 50 expansion threshold in March for the first time since July 2022. However, the services index continued its downward trend for the third consecutive month, though still indicating growth above 50. Expectations are for a partial reversal in April, with the manufacturing index dipping below 50 again and the services index rebounding moderately. Overall, this should result in a slight uptick in the composite index, signaling a pickup in economic activity early in 2024. Additionally, the April CBI industrial survey, postponed from yesterday, will provide insights, including the latest data on business investment intentions.Market attention will also be on any indications supporting an early UK interest rate cut from two Bank of England policymakers scheduled to speak. While Haskel, who recently ceased voting for rate hikes, is unlikely to advocate for a cut, Pill, the Bank’s Chief Economist, may echo Deputy Governor Ramsden’s optimistic remarks from last Friday regarding easing inflationary pressures. Pill's dovish comments today could further bolster expectations for a rate cut by August, following market speculation post-Ramsden’s statements.

Eurozone PMIs may offer optimism for a second-half pickup in economic activity. Projections are for further growth in the services PMI, marking the third consecutive reading above 50, and a rebound in the manufacturing PMI following disruptions in March due to supply chain issues.

The uncertainty surrounding the pace of interest rate cuts by the US Fed heightens the significance of US PMI data for the markets. Another report indicating robust economic growth is anticipated. Moreover, key US releases later this week, including Q1 GDP, will be closely monitored.

Overnight Newswire Updates of Note

BoJ’s Ueda Reiterates Possibility Of Rate Hike If Inflation Rises As Expected

Japan's Suzuki Says 'Groundwork Laid' For FX Action

Japan Manufacturer Activity Close To Expansion In April, Services Grow- PMI

Australian Comp PMI Accelerates To Its Highest Rate In Two Years At 53.6

UK Exports Fewer Goods After Brexit, Tilting Economy To Services

Rishi Sunak Admits Flights To Send Asylum Seekers To Rwanda Delayed

Yen Bounces Off Multi-Decade Low Against USD, Lacks Follow-Through

Crude Hovers Near $83 After Iran Says Will Not Escalate With Israel

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0520-25 (706M), 1.0550 (280M), 1.0590-00 (1.08BLN)

1.0635 (490M), 1.0640-50 (1.6BLN), 1.0700 (216M), 1.0725 (368M)

1.0750 (395M)

USD/JPY: 153.00 (1.36BLN), 154.50 (380M), 154.75 (245M)

154.90-00 (381M), 155.25 (261M)

USD/CHF: 0.8900-10 (394M), 0.9000 (278M)

AUD/USD: 0.6305 (700M), 0.6415-20 (2.7BLN), 0.6475 (309M)

0.6525-30 (2.2BLN), 0.6540-50 (751M)

NZD/USD: 0.5900-10 (502M), 0.6100 (1.13BLN)

AUD/NZD: 1.0700 (555M), 1.0825 (833M), 1.0880 (252M)

USD/CAD: 1.3500 (1.22BLN), 1.3740-55 (729M)

Geopolitical tensions between Israel and Iran, along with the mention of a "rate hike" by the Federal Reserve, caused market volatility, leading to the dollar's gains. However, with the Federal Reserve in a blackout period and limited U.S. data, trading conditions are expected to be calm. This may limit further dollar appreciation and provide relief for other major currencies. Concerns over potential Asia FX intervention from Japan and South Korea may also weigh against the dollar.

CFTC Data As Of 19/04/24

Japanese yen net short position is -165,619 contracts

Swiss franc posts net short position of -36,212 contracts

British pound net long position is 8,619 contracts

Euro net long position is 12,224 contracts

Bitcoin net short position is -363 contracts

Equity fund managers cut S&P 500 CME net long position by 89,326 contracts to 850,042

Equity fund speculators trim S&P 500 CME net short position by 139,497 contracts to 193,791

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5044

Daily VWAP bearish

Weekly VWAP bearish

Above 5044 opens 5073

Primary resistance 5080

Primary objective is 4850

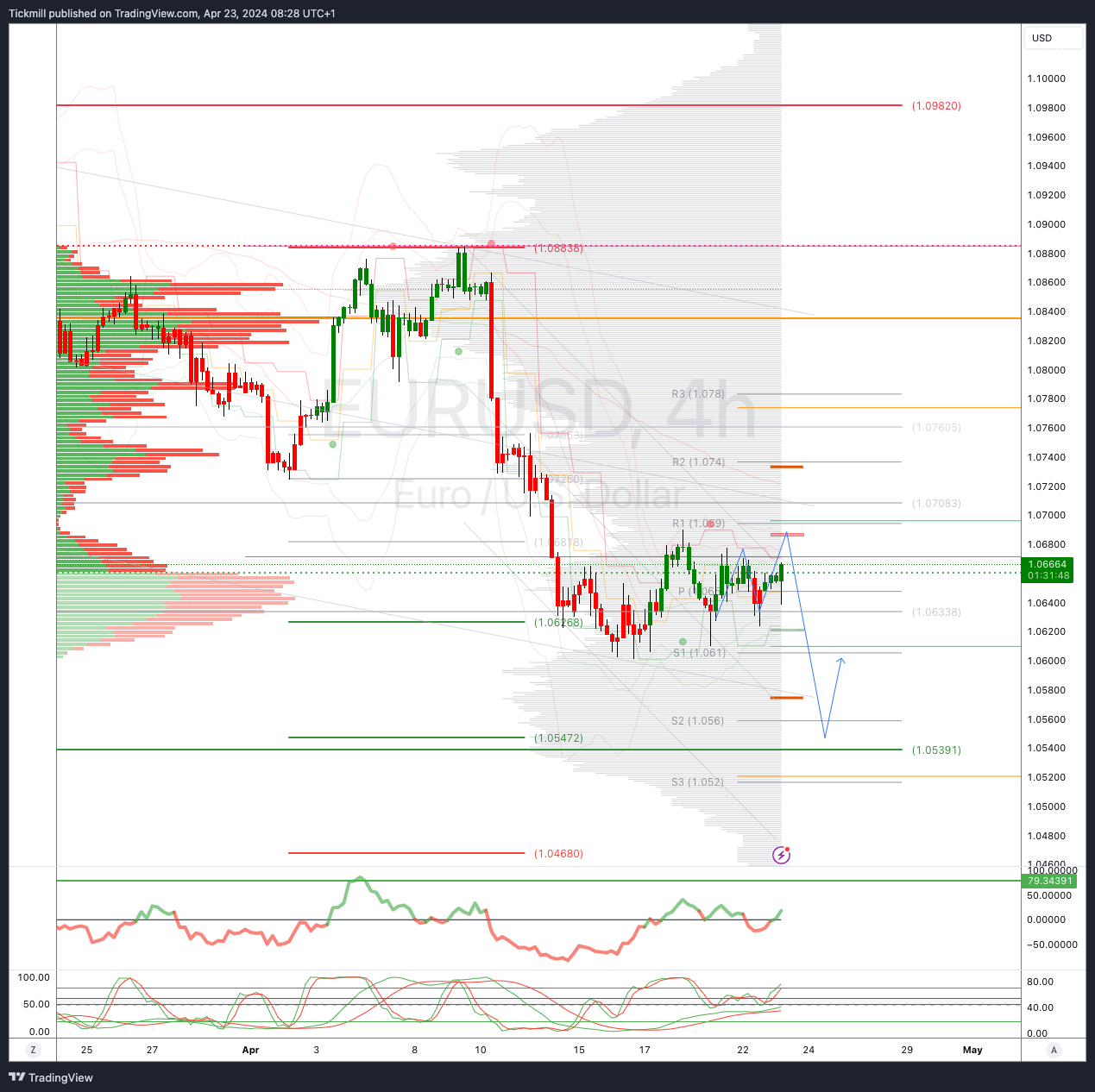

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.24

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2410 opens 1.2460

Primary resistance is 1.2650

Primary objective 1.2350

GBPUSD Bullish Above Bearish Below 1.24

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2410 opens 1.2460

Primary resistance is 1.2650

Primary objective 1.2350

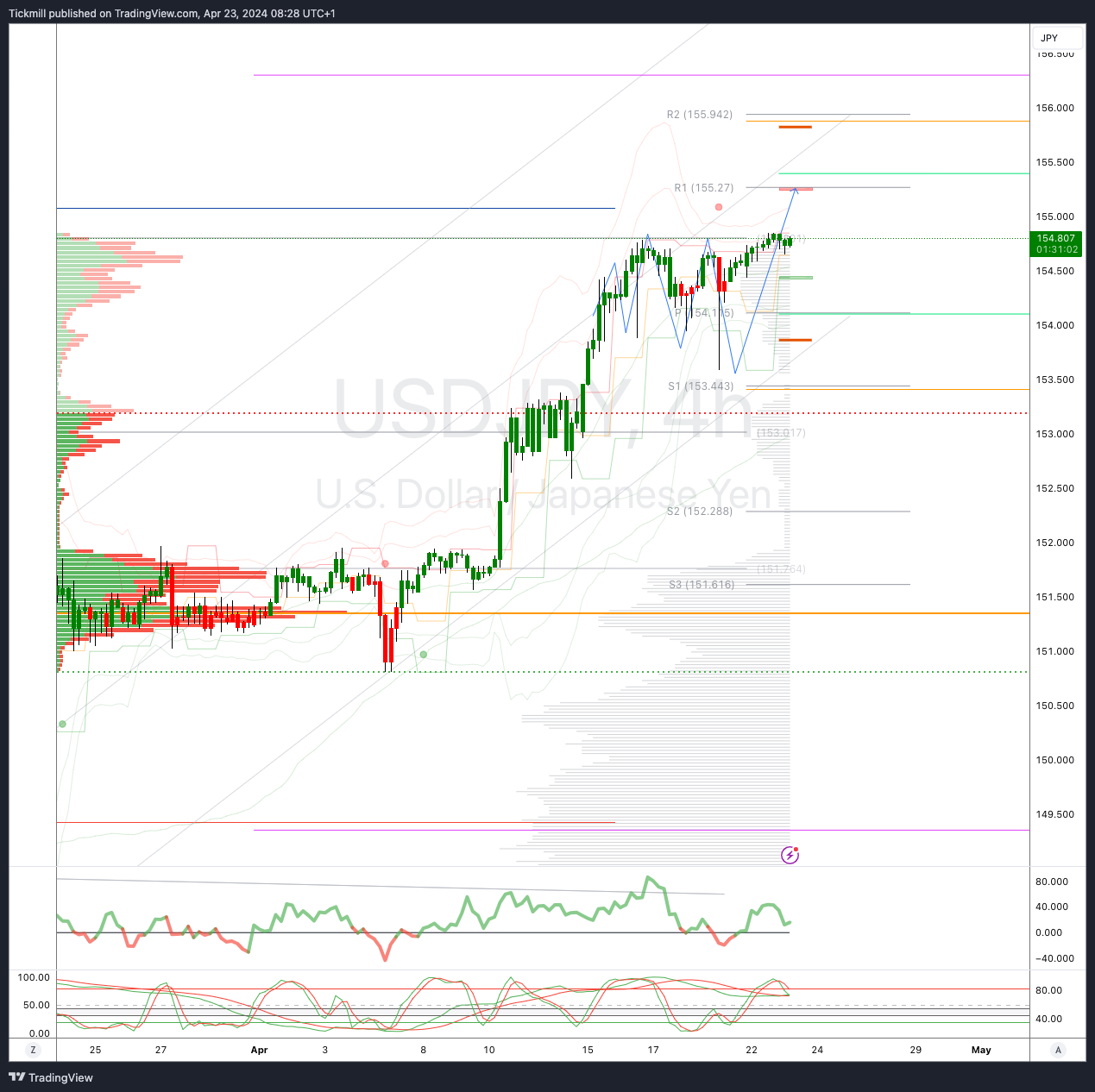

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155

XAUUSD Bullish Above Bearish Below 2417

Daily VWAP bearish

Weekly VWAP bearish

Above 2420 opens 2460

Primary support 2300

Primary objective is 2310 TARGET HIT NEW PATTERN EMERGING

XAUUSD Bullish Above Bearish Below 2417

Daily VWAP bearish

Weekly VWAP bearish

Above 2420 opens 2460

Primary support 2300

Primary objective is 2310 TARGET HIT NEW PATTERN EMERGING BTCUSD Bullish Above Bearish below 66000

Daily VWAP bullish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

BTCUSD Bullish Above Bearish below 66000

Daily VWAP bullish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000 Disclaimer:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Publication date:

2024-04-23 17:40:14 (GMT)

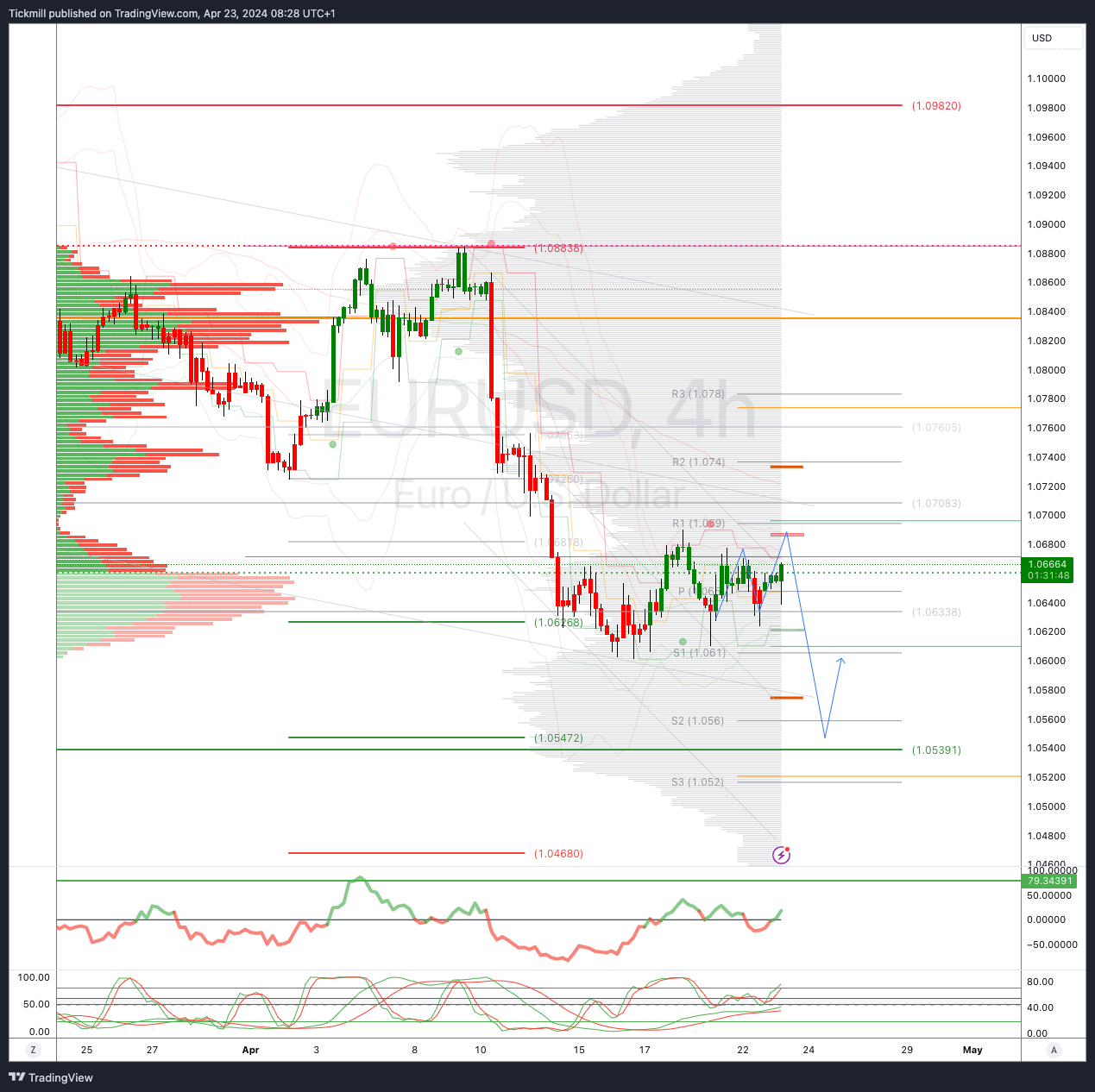

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.24

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2410 opens 1.2460

Primary resistance is 1.2650

Primary objective 1.2350

GBPUSD Bullish Above Bearish Below 1.24

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2410 opens 1.2460

Primary resistance is 1.2650

Primary objective 1.2350

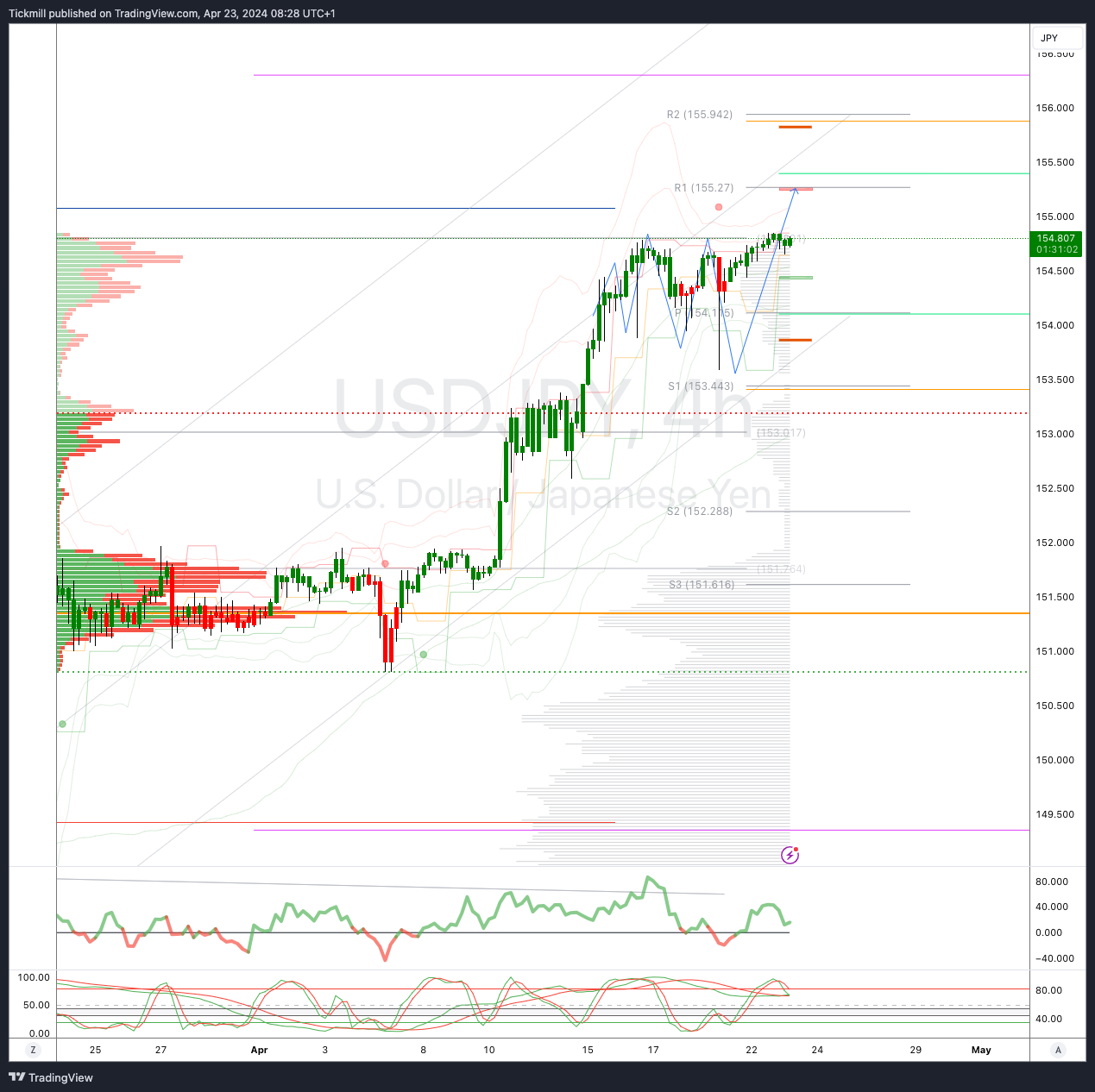

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155

XAUUSD Bullish Above Bearish Below 2417

Daily VWAP bearish

Weekly VWAP bearish

Above 2420 opens 2460

Primary support 2300

Primary objective is 2310 TARGET HIT NEW PATTERN EMERGING

XAUUSD Bullish Above Bearish Below 2417

Daily VWAP bearish

Weekly VWAP bearish

Above 2420 opens 2460

Primary support 2300

Primary objective is 2310 TARGET HIT NEW PATTERN EMERGING BTCUSD Bullish Above Bearish below 66000

Daily VWAP bullish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

BTCUSD Bullish Above Bearish below 66000

Daily VWAP bullish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000